Private residential units sold by developers in March 2024

New private home sales up in March, mainly driven by suburban project launches of Lentor Mansion and Lentoria

Read more

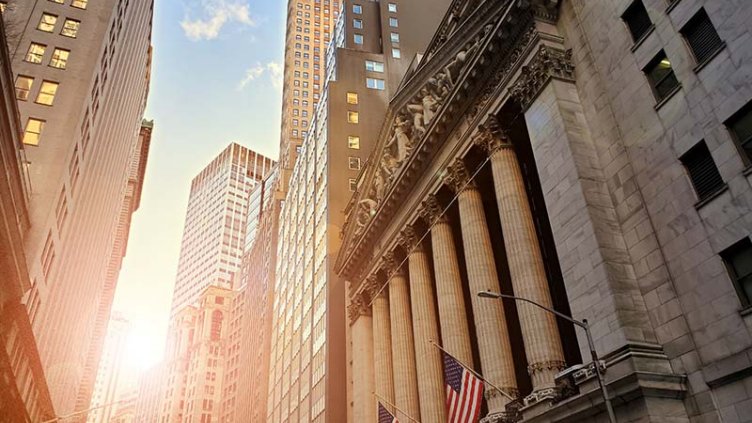

Rethinking the innovation hub model for financial services firms

Tailored workplace and real estate strategies will help strengthen the industry that is being transformed by technology

Read more

Prime Freehold Strata Industrial Units for Sale at Cititech Industrial Building and Citilink Warehouse Complex

The property’s prime location places it in proximity to key destinations

Read more

URA releases flash estimate of 1st Quarter 2024 private residential property price index

Private home prices continue to rise at a gentle pace despite thinner sales volume; cooling measures unlikely in the short-term

Read more