Ease of quarantine is not enough to revive Hong Kong’s retail

It is extremely important for Hong Kong to re-establish itself as a thriving magnet for global high-spending holidaymakers after the full border reopening.

Hong Kong has eased its hotel quarantine period for overseas visitors under a “3+4” arrangement from mid-August. The “3+4” model refers to three days of compulsory quarantine at a designated hotel, followed by four days of medical surveillance at home or self-arranged accommodation. Travellers entering medical surveillance will receive an amber coder via a contact-tracking app, allowing them to leave home for work, school, or other activities such as shopping.

No doubt, this development means a step closer to full border reopening. However, the step is considered too small as many countries have already completely reopened their borders. For example, both Singapore and Thailand reponed borders to fully vaccinated travellers in April and May this year. The market expects that Hong Kong will scrap quarantine measures later this year to welcome some major events, which will certainly help the city gradually regain its international hub status. But is this act enough to revive the city’s retail industry?

Let’s see what happened in Singapore and Thailand after they opened their borders in April and May1.

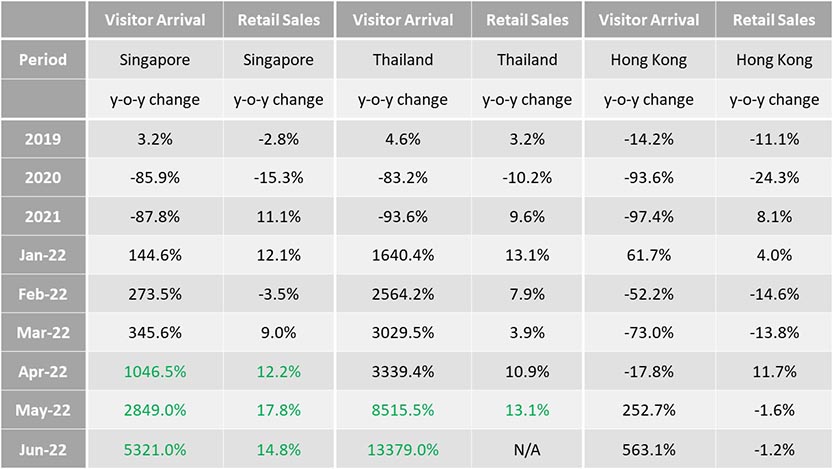

Figure 1: Visitors’ arrival and retail sales growth in Singapore, Thailand, and Hong Kong

Figures show that visitors’ arrival surged substantially after border reopening in both countries. Moreover, the June 2022 visitor arrival figures resumed about 34% and 23% of the 2019 monthly average in Singapore and Thailand, respectively. The retail sales market also recorded growth, despite being at a much smaller magnitude. The disproportionate pickup in the retail market is mainly driven by the sales that did not drop drastically during Covid; hence, the figures do not provide a low base comparison.

The major reasons for the relatively sustained retail sales performance in the two countries, even when visitors’ arrival is almost muted, are:

tourism shopping spending accounted for only about 20% and 12% in Singapore and Thailand, respectively, in 2019; and

retail sales did not drop substantially during Covid, as residents not travelling overseas retained most retail expenses locally besides the government’s stimulus packages supported the Covid-hit economies.

So, what are the key takeaways from the border reopening experience of our neighbouring cities?

While there will certainly be a more visible rebound in both visitors’ arrivals and retail sales once the border fully reopens, the positive effect on retail sales will likely take place gradually. Furthermore, border reopening will encourage tourist spending inflow. However, there will also be leakage of private consumption spent overseas as people resume travelling. Hence, it is extremely important for Hong Kong to re-establish itself as a thriving magnet for global high-spending holidaymakers of all ages.

Hong Kong has been home to a diverse mix of individuals and cultures from different parts of the world. The cultivated global mindset is deeply rooted in the city and is one of the key attributes of Hong Kong. Therefore, the government should take advantage of the current low-rent retail environment to promote the city to overseas retailers and operators to use Hong Kong as a global showcase for their cultures and concepts.

1Singapore – The country ended quarantine for vaccinated arrivals, and no pre-arrival swab tests are required from April.

Thailand – The country dropped the requirements for fully vaccinated international visitors to provide pre-arrival negative PCR test results from May onwards. However, visitors still need to apply for a Thailand Pass and an insurance policy with coverage no less than USD 10,000 on top of a Covid-19 vaccination certificate. From July onwards, travellers only need to show either a vaccination certification or a negative PCR test result.