Singapore CBD and Orchard Road to shine brighter

Singapore CBD and Orchard Road will be even more appealing to investors, occupiers and visitors following a ban on strata-subdivide commercial assets on select sites.

With effect from 15 March 2022, individual unit strata-subdivision of commercial components in standalone or mixed-use developments situated within designated zones in Singapore’s CBD and Orchard Road will be prohibited[1]. Bulk strata-subdivision between uses in mixed developments remains permissible for these sites.

This is a quality assurance stamp for these districts and should boost the asset and land values of the designated sites and neighbourhoods.

Guarantee of quality

Due to the difficulty in obtaining consensus for regular maintenance and upgrades, fragmented ownership of strata-subdivided commercial assets often results in poor upkeep and uncoordinated tenant mix. The phasing out of strata-subdivided commercial assets in designated zones in the CBD and Orchard Road will help remove stains and ensure long-lasting shine following gentrification.

Occupiers and investors can be assured that their assets’ neighbourhoods will retain their lustre, while shoppers can look forward to good quality malls with well-curated retail offerings.

A boost to asset and land values

Single-owned commercial assets typically command a premium in rent over their strata-titled counterparts as they are able to attract quality blue-chip tenants who are good paymasters. Due to concerted and well-coordinated tenant mix curation and marketing efforts, such assets often enjoy higher occupancies than their strata-titled counterparts. These factors culminate in prime, individually owned commercial assets enjoying a more regular and higher stream of rental income compared to strata-titled assets, thus boosting the value of their assets and land.

Will the removal of strata-subdivision entitlement erode the investment appeal of the affected assets in the designated zones?

Prime sites are prized possessions held for the long haul

In land-scarce Singapore, prime commercial sites in the densely built CBD and Orchard Corridor are prized possessions owners hold for the long haul. In the past decade, before this announcement, only 30 Raffles Place had its seven-storey podium strata subdivided and resold following acquisition and asset enhancement works. None of the remaining SGD 26 billion worth of en-bloc assets transacted within the designated zones underwent strata-subdivision for resale. This proves that assets in the designated zones are valued more for their income-producing ability than strata-sale profit potential.

The growing pool of institutional purchasers

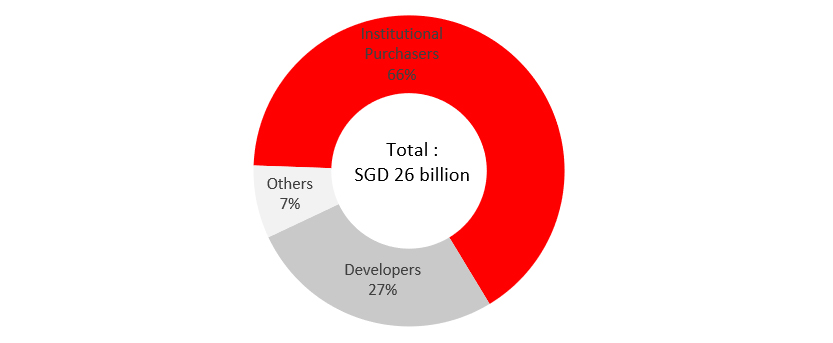

The Singapore commercial investment real estate market has matured and is drawing global funds seeking prime income-producing assets to strengthen their portfolio. In the past decade up to 14 March 2022, institutional purchases accounted for nearly two-thirds of the SGD 26 billion worth of en-bloc assets, including stake sales, that changed hands in the designated zones.

The guarantee of a long-lasting prime quality neighbourhood and the removal of dis-amenity risk posed by degenerating strata-titled assets will elevate the appeal of commercial assets/sites in the designated zones.

Figure 1: Buyers Profile of En- bloc Commercial Deals in Designated Zones (2012-14 March 2022)